Services

I advise investors, founders, and creatives on capital strategy, deal readiness, and growth. My work is industry-agnostic with an emphasis in finance and film.

Strategic Advisory — Investors & Founders

High-stakes decisions around capital, growth, and structure benefit from clarity before urgency sets in. This advisory is most effective before and during moments of inflection across growth cycles. Focus on expansion, partnerships, and long-term positioning.

We slow down to speed up — creating the strategic pauses that allow for accelerated momentum later.

-

I do not provide investor introductions or capital placement. Instead, I advise on investor relations and pipeline strategy — including reporting structure, message discipline, and positioning — to help improve deal flow quality and increase the volume of opportunities entering pipelines in an institutionally sound way.

-

Markets shift, industries cycle, and timing is everything. Forecasting is about giving you the clarity to anticipate change before it arrives. I translate market signals into actionable strategy so you can allocate resources wisely, mitigate risk, and move with confidence. Instead of reacting to the future, you’ll be positioned to shape it.

-

Whether stabilizing ARR, building operational systems, or aligning execution with investor strategy, I provide strategic coverage across CIO, COO, and CMO domains. Each engagement is custom-fit, giving you senior-level clarity and decision support without the long-term overhead of a full leadership team.

-

“I am so happy you saved me from overspending my money elsewhere. I was about to go off and hire a bunch of people, and wait months before talking to investors until I felt “ready” with all of my materials—but since I started working with you, I actually feel like I am saving so much energy and time. I have been so afraid to get started on my dream but you’re helping everything come to life. Thank you for helping me get out of my head and addressing my imposter syndrome.”

Capital Strategy — Film Producers

If you’ve outgrown crowdfunding or pitching to studios but aren’t sure how to reach private investors, or how to talk to them once you do, I will help you bridge that gap. Get unstuck and learn what serious investors look for so you can prepare your project for real conversations and real funding.

——————

“Everything Autumn says is violin music to my ears… and the sound is deafening.” — Elliot Grove, Founder of Raindance

———————

“I can honestly say that nobody is teaching what Autumn is offering and it is based 100% of the reality of financing indie films.” — Institutional Financier & European Executive Producer

———————

Speaking & Enrichment

I bridge creativity and capital — helping investors, founders, and creative operators understand where vision meets structure, economics, and execution. From film finance to capital psychology, I translate complex systems into strategic frameworks audiences can apply immediately.

Whether you host investor forums, leadership salons, or industry convenings, my talks meet audiences where they are and move them forward with clarity. I provide the strategic layer that supports better decision-making, stronger capital alignment, and more disciplined growth.

Every talk is designed to wake people up, shift perspectives, and leave them not just inspired, but equipped to act.

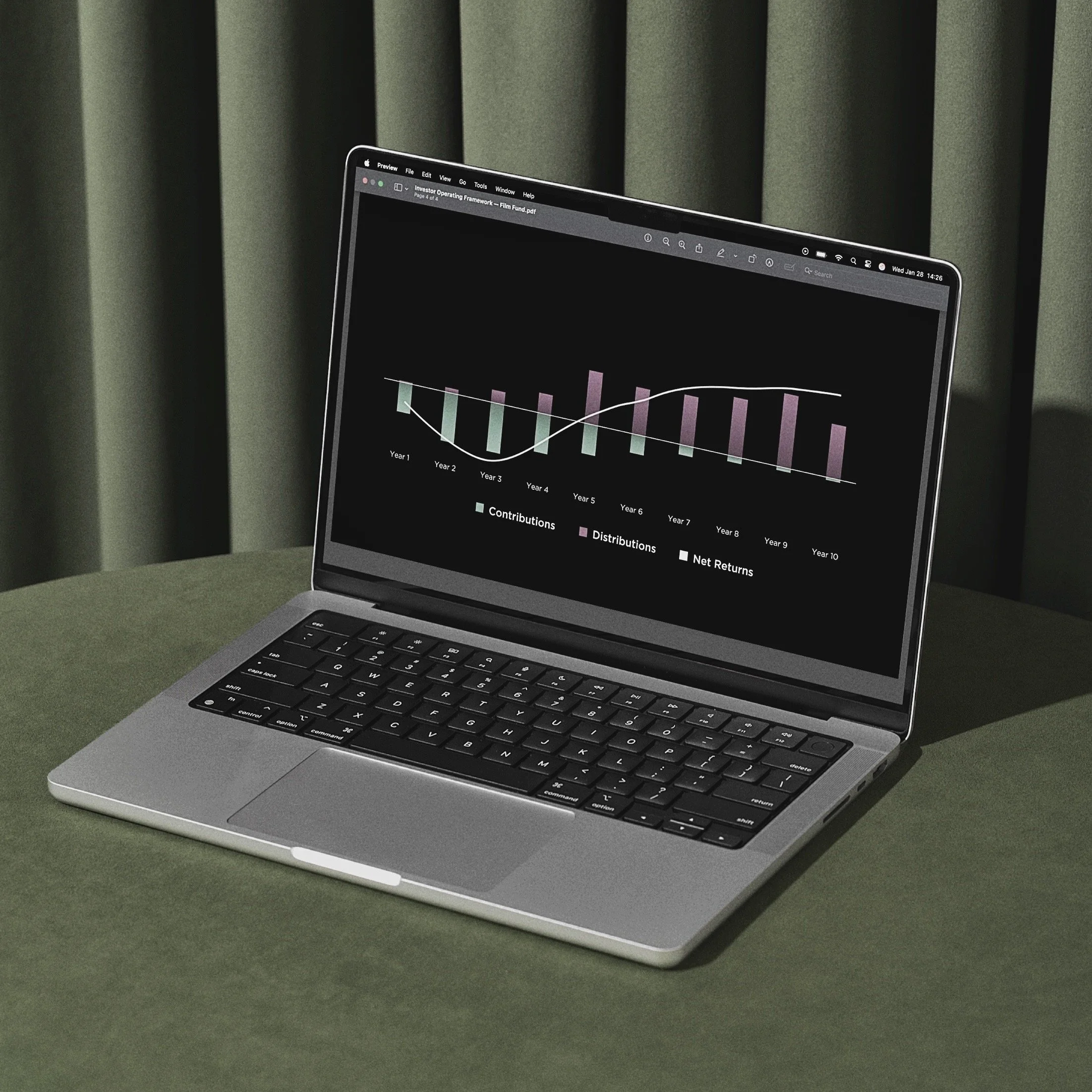

GTM & Investor Operating Frameworks

This work focuses on designing coherent go-to-market and investor operating frameworks for operators preparing for capital engagement or structural scale. I conduct deep-dive audits across operations, capital structure, and execution strategy to identify where momentum is breaking down.

During framework development — we clarify positioning, pressure-test assumptions, and build an investor-ready operating framework that supports disciplined growth, capital conversations, and long-term execution.

-

You will receive:

50+ page GTM or business plan

Debrief meeting to review plan

3-year roadmap for strategic growth

Team interviews conducted for holistic feedback integrated into business plan

-

“Wow! This is exactly what I need—I really don’t want to make the same hemorrhaging mistakes you’ve seen other companies make, and I have been holding off hiring anyone else for this very reason. Thank you for planning three years out, it is great to see a full roadmap of strategic growth. I am now more confident in hiring and onboarding new investors at scale. This is absolutely the answer, and I am definitely ready to start a full advisory agreement with you to put all of this into action.”

Take the Next Step

If you try, you risk failure. If you don’t, you guarantee it.