capital StRATEGY for film producers

You’re closer than you think — but the path forward requires a new language.

If you’ve outgrown crowdfunding or pitching to studios but aren’t sure how to reach private investors — or how to talk to them once you do — I will help you bridge that gap. Get unstuck and learn what serious investors look for so you can prepare your project for real conversations and real funding.

——————

"This is violin music to my ears... and the music is deafening" - Elliot Grove, Founder of Raindance

——————

“I am currently working on developing a finance-raising strategy aimed at independent equity and can honestly say that nobody is teaching what Autumn is offering and it is based 100% of the reality of financing indie films.”

— Institutional Financier & European Executive Producer

90-Minute Strategy Session — Investor Relations

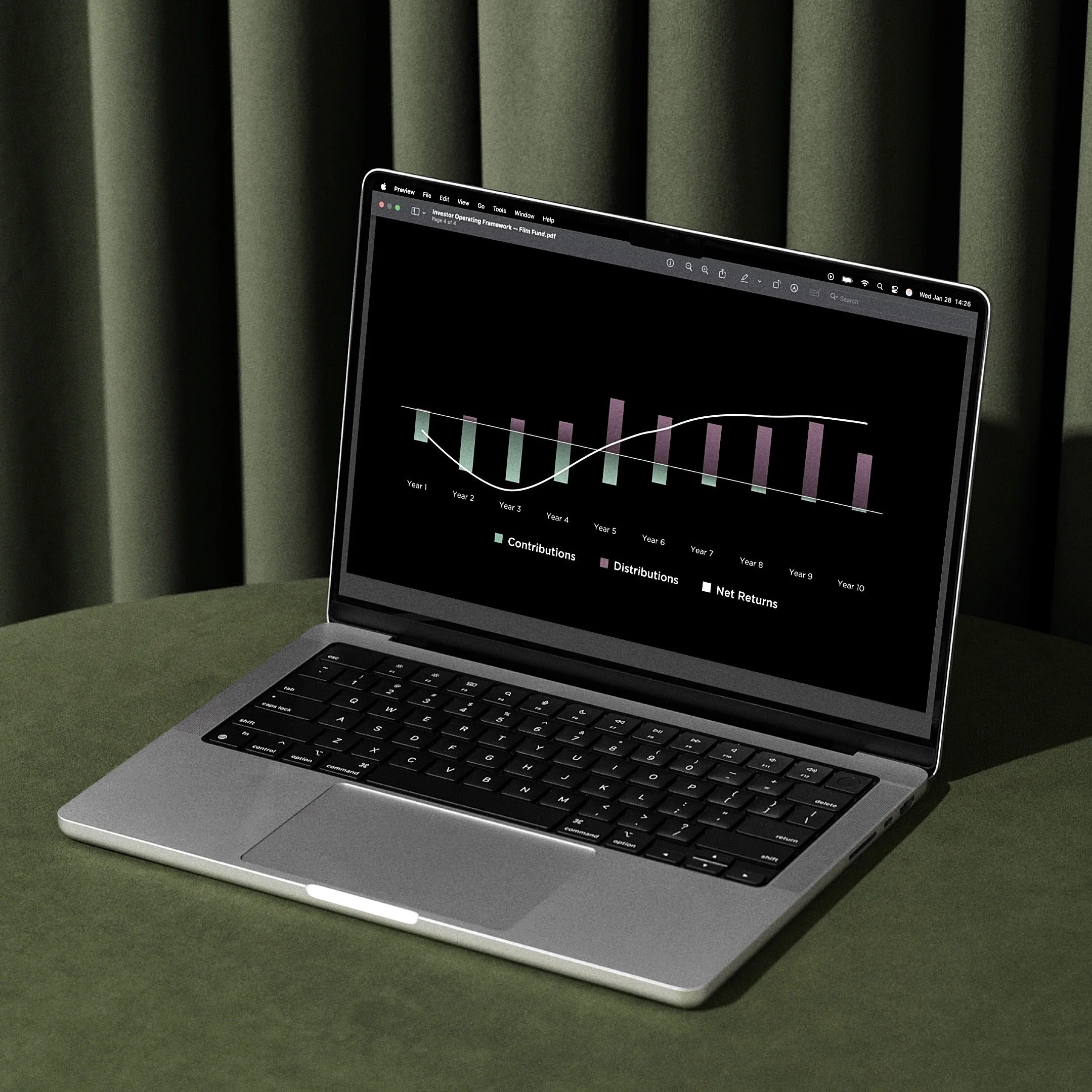

This is a hyper-focused strategic engagement designed to bring clarity to modern film financing frameworks before capital is approached. In a bespoke session, we assess investor readiness, financing structure, investor relations strategy, identify where conversations are breaking down, and design a clear path forward grounded in how private capital evaluates film opportunities.

-

Speaking directly with a private investor is very different than pitching to a studio or incubator. If you want to go the private investor route, this session will help you become a dealmaker while ensuring you’re not wasting anyone’s time, including your own.

-

How do you turn $50K into $10M? Chances are you already have experience raising development or pre-seed funds. During these 90 minutes, I will show you how to spend your start-up cash so you attract serious private investors without wasting money or time.

-

You will receive:

Live advisory during the 90-minute call

Tailored feedback on pitch materials

Copy of strategy session deck

-

“Thanks to you and the direction you have sent me in after our session two months ago, I have already raised $400K from private investors and I have finally established my production company.”

"You are a producer therapist! I am literally spilling my guts out to you. I'm scared to talk to investors, I've never had to do this before. I feel very alone. You are the missing piece to bring everything together."

"It's like I've had body dysmorphia as a producer. This strategy session gave me so much confidence. I need to go for a walk to integrate everything!"

Strategic Advisory — Slate + Fund Development

This is where long-term capital strategy is designed and stabilized. Advisory engagements at this level support pivotal transitions such as building a film slate, structuring a fund, formalizing investor pipelines, and aligning operations for sustained capital deployment.

The work focuses on sequencing, structure, and decision discipline. We create the strategic pauses necessary to reduce friction, protect bandwidth, and prevent overextension, so momentum compounds instead of resets.

-

I do not provide investor introductions or capital placement. Instead, I advise on investor relations and pipeline strategy — including reporting structure, message discipline, and positioning — to help improve deal flow quality and increase the volume of opportunities entering pipelines in an institutionally sound way.

-

“I am so happy you saved me from overspending my money elsewhere. I was about to go off and hire a bunch of people, and wait months before talking to investors until I felt “ready” with all of my materials—but since I started working with you, I actually feel like I am saving so much energy and time. I have been so afraid to get started on my dream but you’re helping everything come to life. Thank you for helping me get out of my head and addressing my imposter syndrome.”

HOLLYWOOD LOST THE PLOT — WE’RE WRITING A NEW ONE

You know that awkward silence you get from a private investor after pitching a deal you’ve poured your heart into? This 68-page strategy guide is what’s not being said.

This isn’t a crash course on pitching. It’s a mirror — a look at what’s actually killing your deals. It’s built from real conversations behind the curtain: quiet passes, raised eyebrows, and investors saying yes based on positioning and readiness.

-

An excerpt from Reason № 5:

“Indie film is evolving, not dying. With major studios pulling back development, private capital is surging — but only for those ready to adapt.

If you’ve been telling yourself, “no one’s funding indie films anymore,” stop. That myth is not only untrue — it’s lazy. It lets you off the hook for doing the hard, strategic work of repositioning your deal for a new market reality.

Even Cannes itself is saying: private investment is the new frontier. Here’s the 2024 Hollywood Reporter quote from Marché du Film executive director Guillaume Esmiol:

“In light of the current financial landscape and Cannes’ unique positioning, we believe it’s relevant to explore new opportunities for funding through private investment.”

Read that again.

The executive running the most powerful film market in the world is telling you where this is going. He’s not panicking. He’s pointing. And if you’re still using the “film is dead” excuse, you’re looking in the wrong direction.”

… read the guide for more.

-

An excerpt from Reason № 10:

“Your deal needs to hit thresholds for them to bother. Under-asking makes it hard for investors to hit their target returns — and easy to ghost you.

There’s a common belief in indie film that asking for less money makes the deal more attractive. That somehow, if you keep your budget lean and your raise modest, you’ll increase your odds of getting funded. But in private capital — especially when working with serious investors — asking for too little is just as bad as asking for too much.

Why? Because sophisticated investors have allocation targets. And if your deal doesn’t allow them to hit their numbers, they’ll quietly move on.”

… read the guide for more.

-

An excerpt from Reason № 13:

“Private investors aren’t studios. Don’t confuse the two. Studios need content. Investors need returns — and you need to speak their language.

One of the quietest ways a film deal dies is when the producer delivers the right pitch — to the wrong audience.

Almost all filmmakers are taught how to pitch like they’re in front of a development executive. You talk about world-building. You highlight the cast wishlist. You reference other hit shows or Sundance winners. You’re excited about tone, aesthetics, and the cultural relevance of your story.

And to be clear — all of that matters. But only when you’re speaking to someone who’s in the business of acquiring content.

A private investor isn’t.”

… read the guide for more.

What Producers Are Saying

“Thanks to Autumn and the direction she has sent me in after our session two months ago, I have already raised $400K from private investors and I have finally established my production company.”

— Founder and Executive Producer of U.S. Film Production Company

“I am ready to go back out there and reintroduce myself. I now know how to communicate and position myself. I feel a lot more relaxed now with a process in place. This has been mind blowing.”

— Founder & Executive Producer, U.S. AI Film Production Company

“A seasoned investor I spoke to last week was impressed to hear that Autumn's capital strategy for my media fund is in alignment with all of the lessons she had to learn the hard way.”

— Founder and Executive Producer of European Media Fund

“I cannot thank Autumn enough for the amount of guidance and aid she has provided me in just two meetings. I'll for sure reach out to her in the near future for more guidance on my feature films.”

— NYU Film Graduate 2025

"Autumn has the creative talents and technical skills to be comfortable and productive in all aspects of filmmaking. She can develop a story to screenplay, produce a film, and be its cinematographer and editor. Not everyone can wear so many hats easily. She is dedicated to telling stories about the human condition that are both emotional and provocative. I look forward to watching her career grow and thrive for years to come."

— Jennie Lew Tugend, Producer of Lethal Weapon

Take the Next Step

Uncover what’s missing so you can approach private investors with success.